Threats of funds laundering have impacted the digital earth with its incorporation into economic providers and other emerging markets. Back again in 1988, a concern about money laundering was raised by the UN in Vienna. Nevertheless, alarming circumstances occurred when the believed number of laundered revenue was calculated, achieving virtually 2 trillion USD.

As it was just an approximation and not the precise amount, the organization sector made a decision to just take account of all the illegal operations executed in the electronic landscape. There are other approaches to launder income digitally, which include dollars payments and account takeovers. Economic funding consists of 3 distinctive levels of cash laundering. No question, the misuse of cloud-centered methods has wedged the money sector, primary them to locate robust remedies in opposition to illegal funds trade crimes.

What Income Laundering is?

Money laundering or illegal funding refers to the process of exchanging a transaction that is received wrongly and is shifted to a very clear origin, portraying it as lawful. The laundered dollars aimed to be utilized for numerous functions that are illegal. These activities incorporate terrorist funding, tax evasion, and ill-attained incomes. The expression originated from the United States, referring to the mafia people today utilizing the funds for unlawful purposes. In other phrases, unlawful funds is the underground movement of income transferring from one location to the other dodging the legal techniques.

Discover Distinctive Revenue Laundering Approaches

Transferring unlawful cash is no big offer in a globe in which everything is operated digitally. Imposters and other monetary criminals are associated in a number of methods for laundering payments and dodging the federal government programs. These ways involve:

- Muling money

- Bogus invoices

- Manipulating electronic industry

- Online deposit styles

- A number of lender transactions

- Dollars trafficking, and so on.

These are some of the ways to execute illegal resources with out acquiring caught. Nonetheless, all these processes final result in getting rid of the company’s standing and asset reduction. Additionally, phases of the funds laundering process stages are mentioned in element.

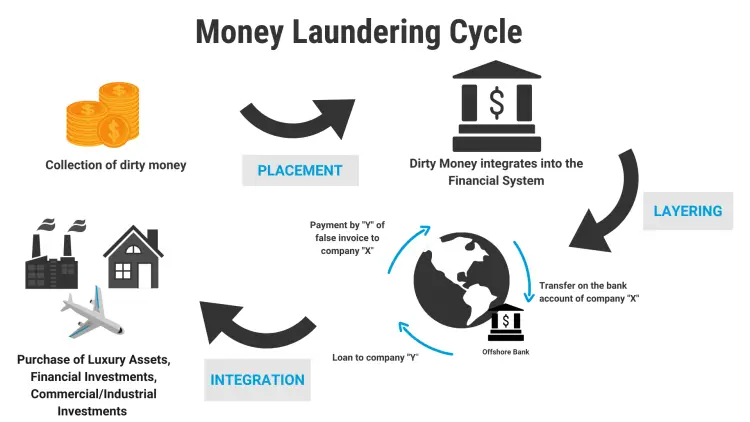

Key Levels in Cash Laundering

Let us dive into the comprehensive assessment of how money is laundered in three main stages concerning the monetary procedure to integrate fast answers.

- Placement

Placement refers to the first stage in the unlawful funding procedure. The key concept of the word is to entry the medium manipulation to position the money in the legal economic climate. The procedure functions by getting illegal transactions and exploring the placements in the money sectors to split massive transactions into chunks. The complete tactic would make it intricate for providers to detect illicit dollars exchanges and helps fraudsters in tricking the methods.

- Layering

In this stage, the fraudsters make a number of layers of the transaction, generating it sophisticated for the fiscal sector to examine unlawful cash. It helps the imposters to transfer even further laundered revenue by blending the money with authorized cash trade. Also, it is referred to as one particular of the sophisticated phases of money laundering.

- Integration

And finally, the criminals included integrating unlawful income payments and other transactions received. Integration involves enabling the scammers to dodge the method and go the laundered money with out owning the anxiety of staying caught. The integration section puts back again the laundered transactions to the imposters even though emulating it to be received by a legal resource.

How Anti-Income Laundering Criteria Aid in ML Preventions

Income laundering crimes have attained a issue the place businesses call for prompt answers with solid approaches the AML requirements and compliance have manufactured it achievable for them to experience this sort of things to do. Anti-dollars laundering stages create check approaches and offer insights into unlawful cash exchanges. This assisted the electronic field in screening and inspecting the transaction, generating it feasible for firms to include. Outlined down are some of the options AML checks combine:

- Risk Assessment

- Continuous screening

- Payment checking program

- Sanction screening

- Adverse checking technique

- AML for businesses

- Fraud inspection

- Consumer verification

- Batch screening and so on.

All these work on a one basic principle of inspecting illegal or unsure transactions when defending the marketplace in opposition to fraudulent operations. It contains the two-way screening of individuals using APIs and a file storage tactic. The AML procedure operates right away with extensive proof of verification.

You could possibly also like to go through

How to Get A lot more Client Opinions?

How Extended Will It Acquire Me to Get to Work Each and every Working day?

Conclusion

Providers doing the job in the economical sector and dealing with funds call for customer verification and screening to shield corporations. The AML screening and ongoing approach help in inspecting the stages of funds laundering whilst supplying a seamless onboarding working experience to new customers. Validating the firms in opposition to the sanction listing allows in lowering the red flags of AML. Furthermore, the entire strategy is totally automated and involves an exhaustive AML database. Revenue laundering stages can be encountered with improved data security and an interactive user interface for easy integration.